MONTHLY PAYMENTS WITH NO INTEREST OR FEES

FLEXIBLE PAYMENTS MADE SIMPLE

Splitit allows you to use your existing credit card to split your purchase into installments with no interest or fees. No lengthy applications needed.

WHY SPLIT YOUR PURCHASE

ONE CLICK FOR MONTHLY PAYMENTS

To use Splitit, simply select “Monthly credit card payments” at checkout and you will be redirected. No application needed. No impacts on your credit.

HOW SPLITIT WORKS

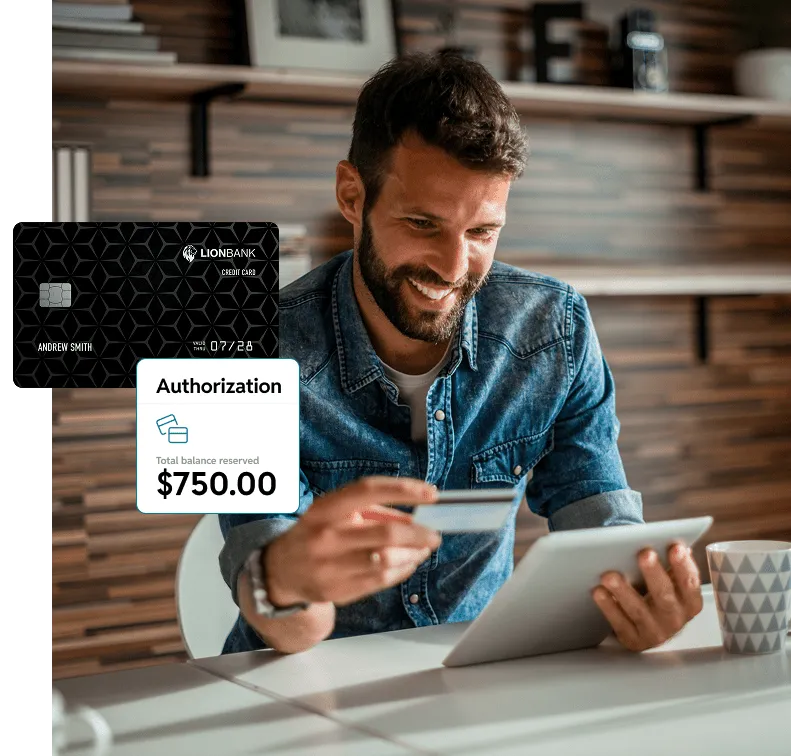

Splitit guarantees your purchase by placing a hold on your credit card. This is not a payment, it’s just a pre-authorization that allows you to pay off your balance over time. You get all the benefits of paying with your credit card, including rewards, transaction insurance, and protection against fraud.

AUTHORIZATION

When you use Splitit, we place an authorization on your existing credit card for the full purchase amount. To use Splitit, you’ll need enough available credit on your card to cover the full purchase amount at the time of checkout—even though only the first installment will be charged right away.

INSTALLMENT PLAN

The first installment is charged a few seconds after the purchase authorization. Splitit will charge your credit card every month until the plan is finished.

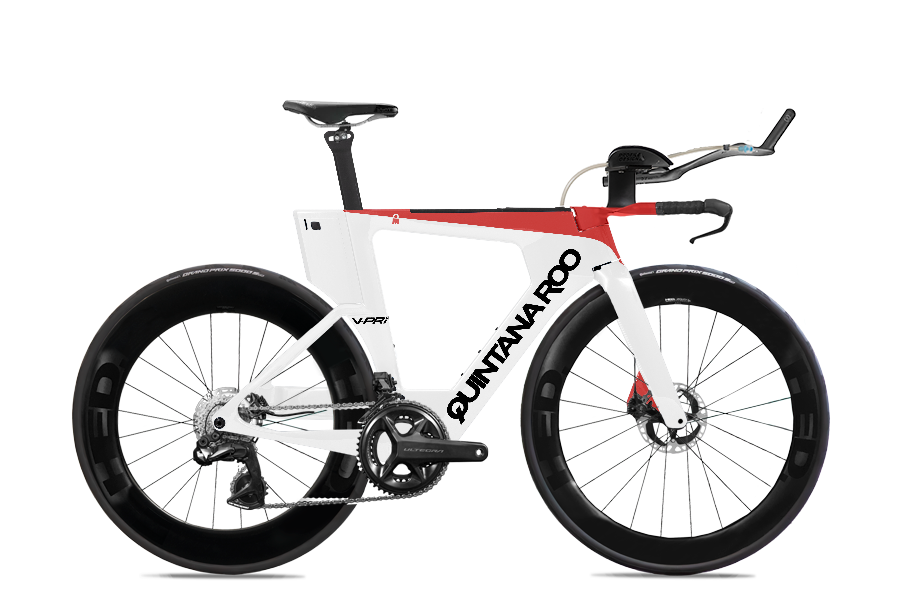

ELIGIBLE QUINTANA ROO PRODUCTS

FREQUENTLY ASKED QUESTIONS

Retail Plan: In this option, Splitit enables the merchant to offer you the ability to pay in installments using your existing credit card with no added fees. Your credit card issuer’s terms and fees still apply.

Splitit Financing: In this case, Splitit provides the installment plan directly to you via the merchant’s checkout. Finance charges apply and are clearly shown to you before you confirm. The terms and rates are outlined in the agreements you have received.

To check which type of plan you are on, please log in to your shopper portal.

You can start a live chat with us, or visit our support center.

No, unfortunately not. We are only able to accept credit cards at the present time.

The supported credit cards vary depending on the merchant and plan selected. We typically accept Visa, Mastercard, and depending on the merchant, American Express, Discover and UnionPay.

Yes. Splitit helps consumers use their existing credit card to turn purchases into smaller, flexible payments.

The full amount of your purchase, plus finance charges if your plan includes interest, is authorized (held) on your credit card to guarantee future payments so you need to have at least that amount plus finance charges in available credit on your card.

You can find all our terms and conditions here.

If your plan includes interest, the installment amount and the interest are authorized separately on your credit card.

For Retail Plans there are no additional fees or interests. Your credit card issuer’s terms and fees apply.

For Splitit Financing a finance charge of up to 36% may apply, depending on state and federal laws; however, Splitit does not charge any late fees, prepayment penalties, or other associated fees.

No. No new credit checks are required to use either a Retail Plan or Splitit Financing. Splitit does not report to the credit bureaus.

“My experience with QR has been incredible from ordering up to delivery. Customer service was in touch with me every step of the way, and my bike was sent out quickly…”

WHY RIDE QR?